The company, which dominates the market for chips used to build artificial intelligence, expects another big jump in the current quarter.

Nvidia, which dominates the market for computer chips used to build artificial intelligence, has become a Wall Street sensation.

Over the past year, it has increased its market value by $2.5 trillion and dethroned Apple as the world’s most valuable tech company. But Nvidia’s success has raised questions about how long its run can last.

On Wednesday, Nvidia showed that the world’s seemingly insatiable appetite for A.I. technology could lift its business to new highs. The company, a bellwether for A.I., topped Wall Street’s expectations for the quarter, reporting that revenue jumped 94 percent from a year ago and profit increased by 106 percent during the three months that ended in October.

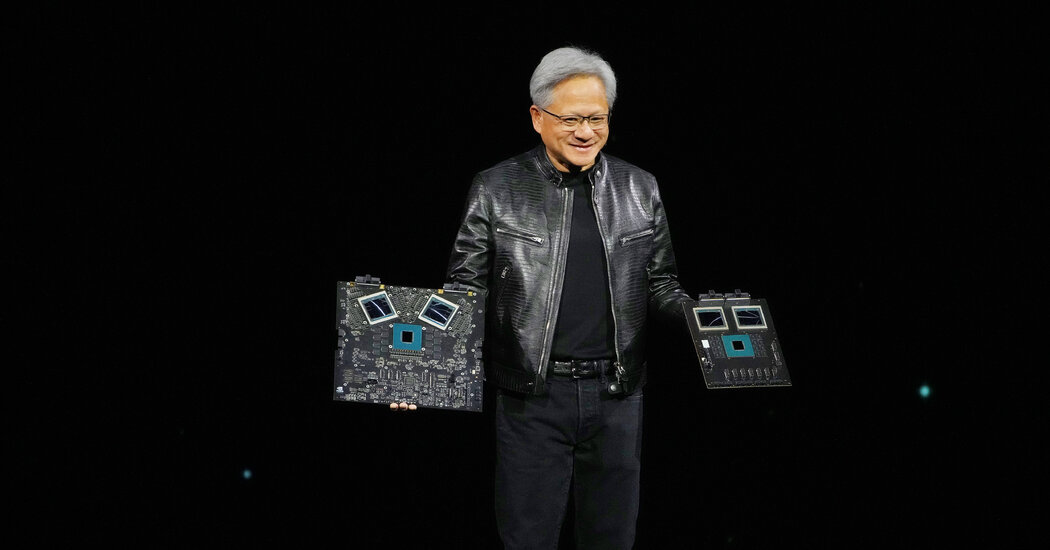

Nvidia also projected that revenue in the current quarter would rise by 70 percent from a year ago to $37.5 billion, as it began selling a new, more powerful A.I. chip called Blackwell. The forecast exceeded Wall Street’s prediction by about $500 million and suggested that customers were lining up to purchase the new chip.

Revenue in the quarter ending in October was $35.08 billion, surpassing the company’s estimate of $32.5 billion in August. Net income rose to $19.04 billion from $9.24 billion a year ago, exceeding the quarterly profits of Amazon and Meta.

Shares in Nvidia fell 3 percent in after-hours trading, partly because its sales outlook was dampened by supply constraints on its new chip.