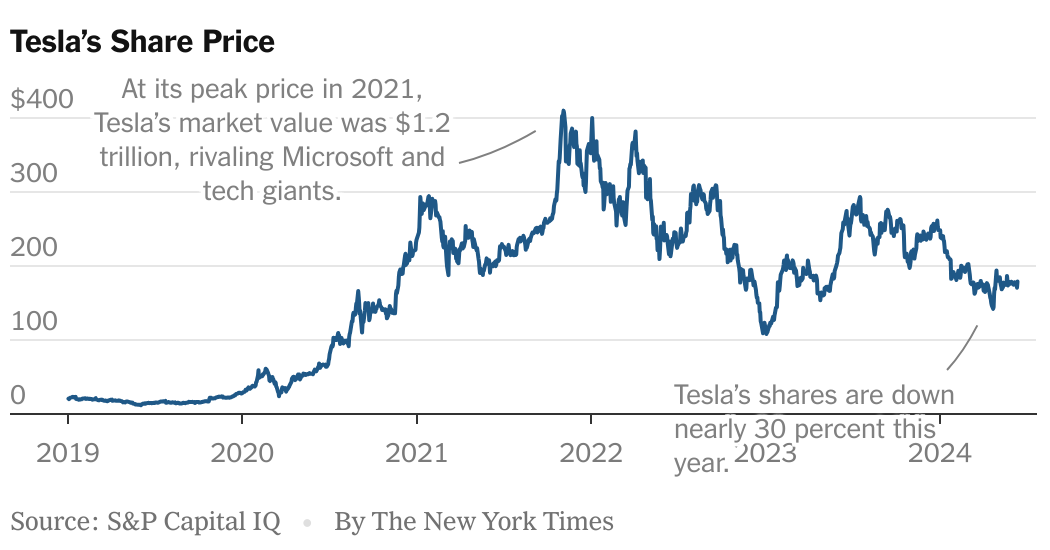

A huge run-up in the stock’s value followed a 2018 vote on Elon Musk’s compensation package. But investors have recently become less enamored.

The Tesla shareholder vote over Elon Musk’s pay is in some ways a referendum on the performance of the company and its chief executive.

But even before the vote concludes on Thursday, Tesla’s stock price shows that investors have plenty of doubts about Mr. Musk and the electric carmaker’s outlook.

Tesla’s shares are down nearly 30 percent this year, even as the broader stock market is up 14 percent. At its peak in 2021, the stock market value of Tesla was $1.2 trillion, putting it in the company of tech giants like Microsoft, Apple and Google. Its worth has since plunged to around $576 billion, ranking it alongside less racy companies like Visa and Walmart.

Blame concerns about Tesla’s business.

The company is facing stiffer competition, and though its main models have sold extremely well, demand for them seems to be sagging. Price cuts aimed at stimulating interest are eating into profit margins. And analysts say there are no new models coming soon that could set off another buying wave.

“They’ve really struggled to grow,” said Toni Sacconaghi, a stock analyst at Bernstein who covers Tesla. “And part of the reason they’ve struggled to grow is they have no new models.”

Tesla’s profit in the first quarter fell 55 percent, to $1.1 billion, from a year earlier, while revenue fell 9 percent, to $21.3 billion. The company disclosed plans to lay off 10 percent of the work force, or 14,000 people.