Using advanced computers, he went from M.I.T. professor to multibillionaire. His Medallion fund had 66 percent average annual returns for decades.

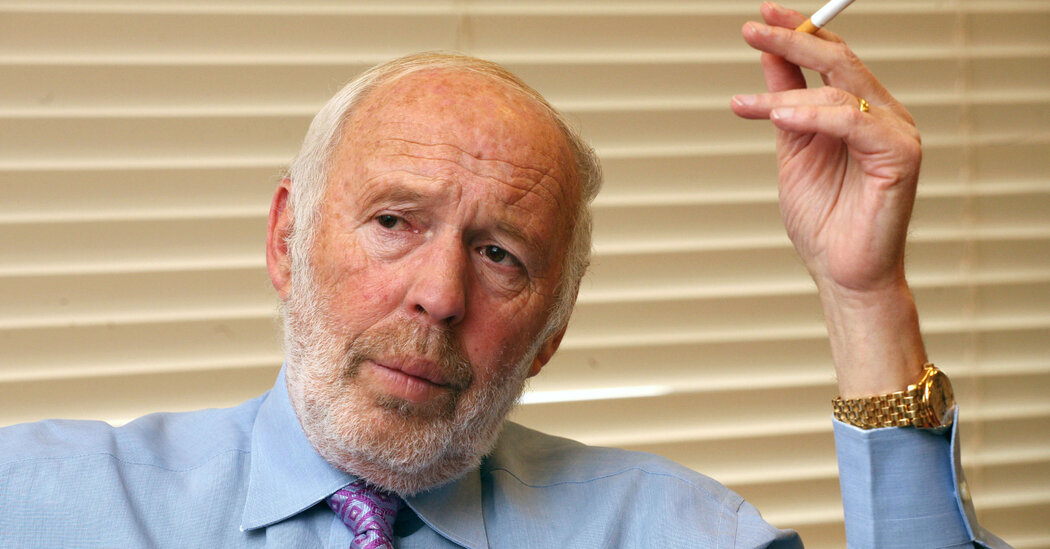

Jim Simons, the prizewinning mathematician who abandoned a stellar academic career, then plunged into finance — a world he knew nothing about — and became one of the most successful Wall Street investors ever, died on Friday in his home in Manhattan. He was 86.

His death was confirmed by his spokesman, Jonathan Gasthalter, who did not specify a cause.

After publishing breakthrough studies in pattern recognition, string theory and a framework that combined geometry and topology with quantum field theory, Mr. Simons decided to apply his genius to a more prosaic subject — making as much money as he could in as short a time as possible.

So at age 40, he opened a storefront office in a Long Island strip mall and set about proving that trading commodities, currencies, stocks and bonds could be nearly as predictable as calculus and partial differential equations. Spurning financial analysts and business school graduates, he hired like-minded mathematicians and scientists.

Mr. Simons equipped his colleagues with advanced computers to process torrents of data filtered through mathematical models, and turned the four investment funds in his new firm, Renaissance Technologies, into virtual money printing machines.

Medallion, the largest of these funds, earned more than $100 billion in trading profits in the 30 years following its inception in 1988. It generated an unheard-of 66 percent average annual return during that period.

That was a far better long-term performance than famed investors like Warren Buffett and George Soros achieved.