A little-known data firm helps health insurers make more when less of an out-of-network claim gets paid. Patients can be on the hook for the difference.

Weeks after undergoing heart surgery, Gail Lawson found herself back in an operating room. Her incision wasn’t healing, and an infection was spreading.

At a hospital in Ridgewood, N.J., Dr. Sidney Rabinowitz performed a complex, hourslong procedure to repair tissue and close the wound. While recuperating, Ms. Lawson phoned the doctor’s office in a panic. He returned the call himself and squeezed her in for an appointment the next day.

“He was just so good with me, so patient, so kind,” she said.

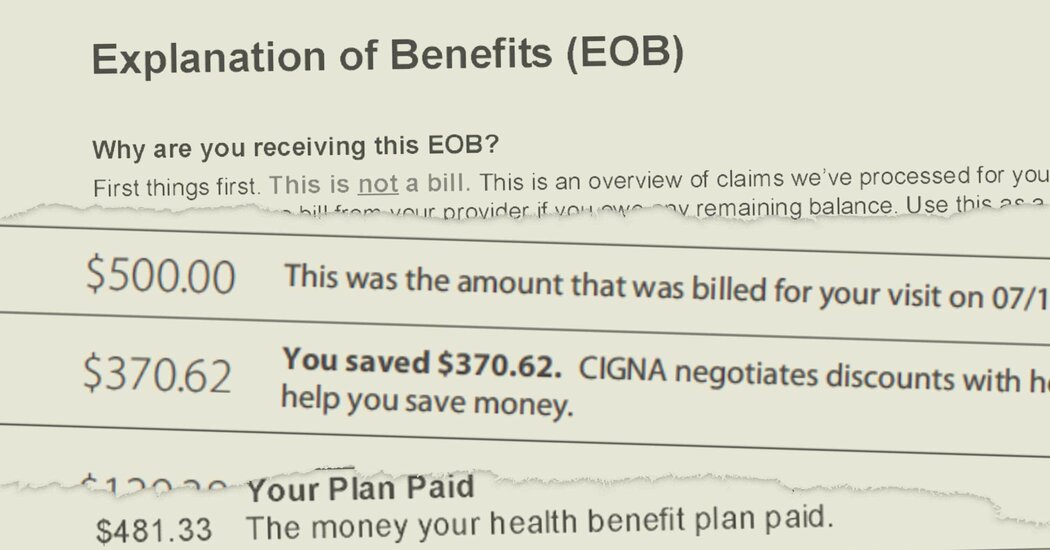

But the doctor was not in her insurance plan’s network of providers, leaving his bill open to negotiation by her insurer. Once back on her feet, Ms. Lawson received a letter from the insurer, UnitedHealthcare, advising that Dr. Rabinowitz would be paid $5,449.27 — a small fraction of what he had billed the insurance company. That left Ms. Lawson with a bill of more than $100,000.

“I’m thinking to myself, ‘But this is why I had insurance,’” said Ms. Lawson, who is fighting UnitedHealthcare over the balance. “They take out, what, $300 or $400 a month? Well, why aren’t you people paying these bills?”