The move is a bet that Ampere’s chips can begin playing a significant role in data centers for creating artificial intelligence.

SoftBank said on Wednesday that it had agreed to pay $6.5 billion for the Silicon Valley chip start-up Ampere Computing, doubling down on a bet that technology that originated in smartphones will come to dominate the world’s data centers.

The deal also reflects the Japanese conglomerate’s belief that Ampere’s chips can begin to play a significant role in artificial intelligence, where Nvidia has reaped the most rewards so far.

Ampere was founded eight years ago to sell chips for data centers based on technology from Arm Holdings, a British company that licenses chip designs that have powered nearly all mobile phones. SoftBank, which bought Arm in 2016, has been working to have chips based on Arm technology used more widely and for different tasks.

“The future of artificial superintelligence requires breakthrough computing power,” Masayoshi Son, SoftBank’s chairman and chief executive, said in prepared remarks. “Ampere’s expertise in semiconductors and high-performance computing will help accelerate this vision, and deepens our commitment to A.I. innovation in the United States.”

SoftBank said it would operate Ampere as a wholly owned subsidiary under its own name.

The sale comes amid a flurry of deals and shifting alliances driven by a furious demand for the chips used to power A.I. applications such as OpenAI’s ChatGPT. SoftBank, in particular, has announced a series of transactions in a bid to play a bigger role in the field.

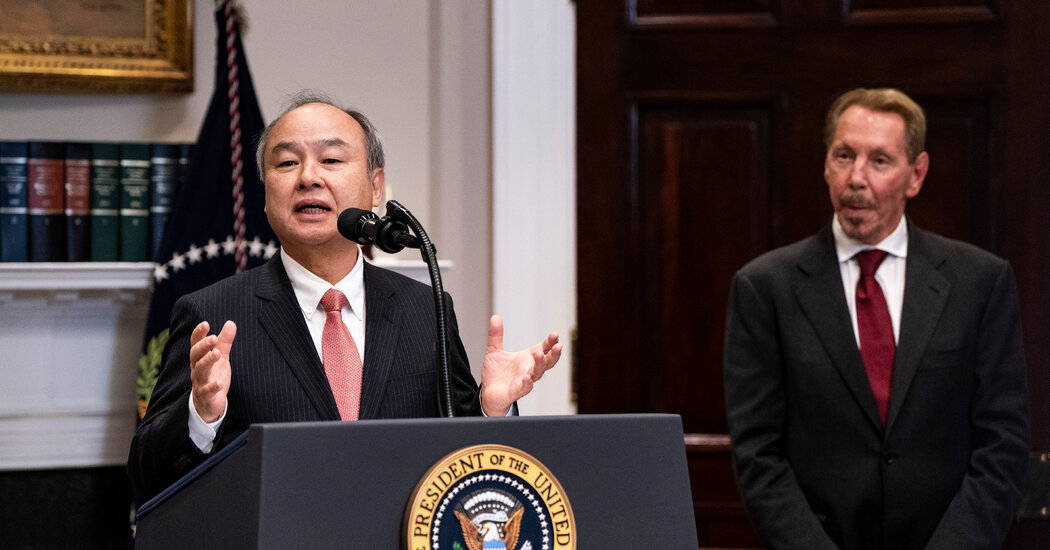

In its splashiest move to date, Mr. Son joined President Trump in January to announce an initiative called Stargate, alongside Sam Altman, OpenAI’s chief, and Larry Ellison, chairman and founder of the software maker Oracle, which is Ampere’s largest investor and customer.