In 2005, there was no inkling of the artificial intelligence boom that would come years later. But directors at Intel, whose chips served as electronic brains in most computers, faced a decision that might have altered how that transformative technology evolved.

Paul Otellini, Intel’s chief executive at the time, presented the board with a startling idea: Buy Nvidia, a Silicon Valley upstart known for chips used for computer graphics. The price tag: as much as $20 billion.

Some Intel executives believed that the underlying design of graphics chips could eventually take on important new jobs in data centers, an approach that would eventually dominate A.I. systems.

But the board resisted, according to two people familiar with the boardroom discussion who spoke only on the condition of anonymity because the meeting was confidential. Intel had a poor record of absorbing companies. And the deal would have been by far Intel’s most expensive acquisition.

Confronting skepticism from the board, Mr. Otellini, who died in 2017, backed away and his proposal went no further. In hindsight, one person who attended the meeting said, it was “a fateful moment.”

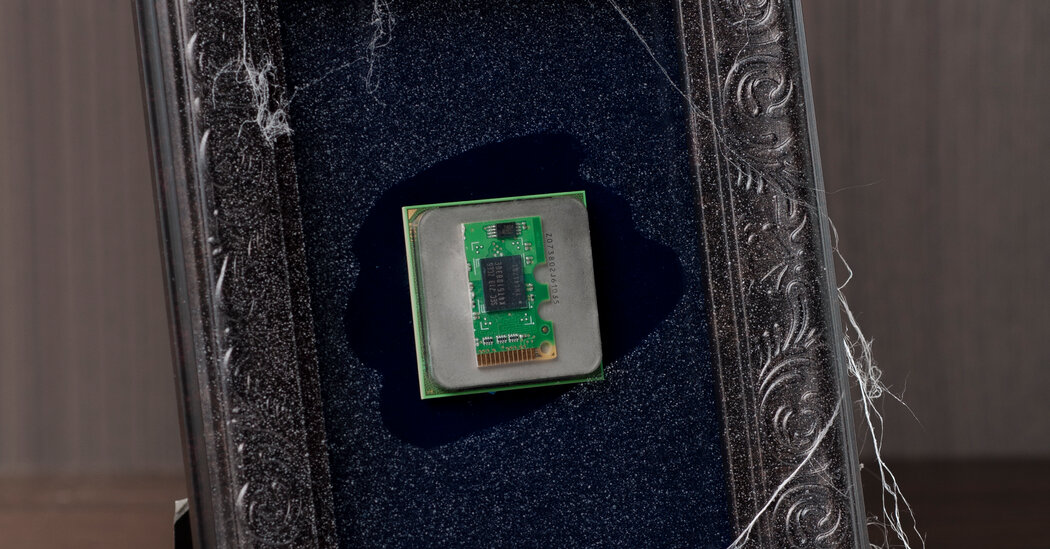

Today Nvidia is the unrivaled A.I. chip king and one of the most valuable corporations in the world, while Intel, once the semiconductor superpower, is reeling and getting no lift from the A.I. gold rush. Nvidia’s stock market value, for years a fraction of Intel’s, is now more than $3 trillion, roughly 30 times that of the struggling Silicon Valley icon, which has fallen below $100 billion.